Introduction Specialty Finance

The fascinating field of specialty finance is yours to explore. This article is for you if you have ever wanted to know how specific businesses handle their money. Niche industries have unique funding needs, and a new dynamic industry called specialty finance has arisen to meet those needs. By providing individualized solutions that match the changing needs of specific industries, specialty finance companies are changing the way traditional lending is done in sectors including healthcare, real estate, technology, and transportation.

Learn what specialty finance is, how it has grown rapidly over the years, the various kinds of specialty finance companies, the pros and cons of each, how to invest in this exciting new field, and what the future holds for this exciting industry. Hold on tight, because you’re about to embark on an enlightening adventure into the intriguing world of specialty finance!

The Concept of Specialty Financing

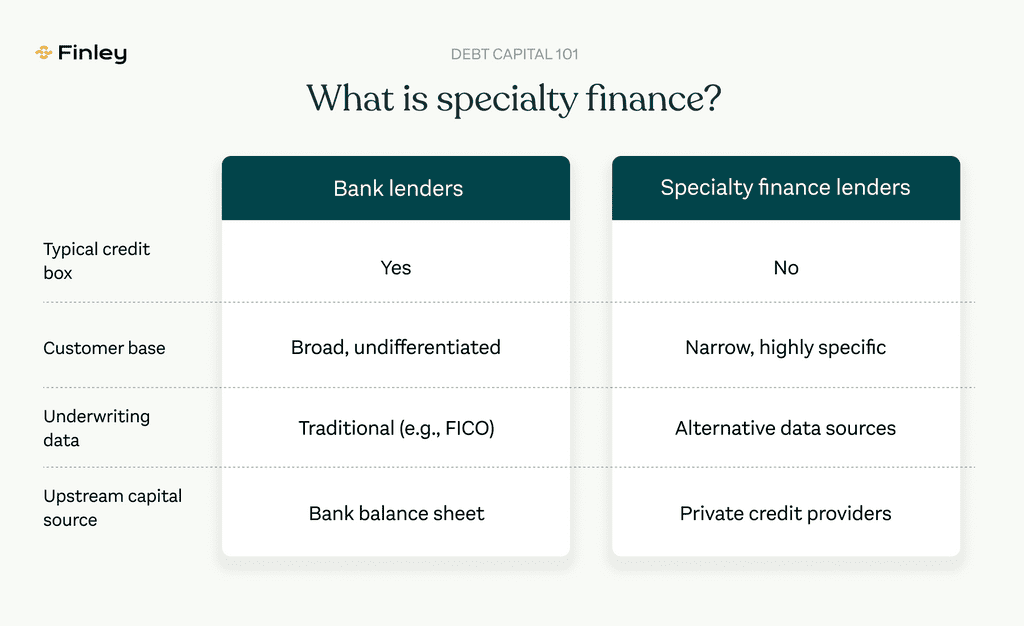

As a subset of the banking industry, specialty finance is concerned with catering to the unique needs of companies in certain niches by way of tailored investment and loan solutions. A specialty finance company, as opposed to a regular bank, will take the time to learn about your industry’s specific problems and prospects so that you may get the financing that works best for you.

Healthcare, real estate, software startups, consumer financing, equipment leasing, and other industries are common clients of these specialty lenders. Investments in venture capital, asset-based lending, factoring, and mezzanine finance, and royalty-based arrangements are just a few of the different funding forms they offer.

The capacity of specialty finance to evaluate risks linked to non-traditional borrowers and collateral kinds is one of its fundamental differentiators. Specialty finance companies use their knowledge of the industry to assess risk in a different way than regular banks, which may be reluctant to lend to high-risk ventures or those without significant physical assets to secure the loan. The underwriting process considers a number of characteristics specific to each niche market, such as the value of intellectual property in the creative industries or the frequency of revenue streams in software-as-a-service (SaaS) enterprises.

The Expansion of the Sector of Specialty Financing

There has been meteoric rise in the specialty finance sector in the last several years. Financing solutions for niche industries that conventional banks and other lending institutions may overlook are the primary emphasis of this industry. Specialty finance firms have been able to access underserved markets and meet their particular funding requirements thanks to the proliferation of alternative lending platforms and cutting-edge financial technologies.

The healthcare industry is one that has grown significantly. There has been a recent uptick in the number of specialty finance companies offering individualized financing solutions to healthcare practitioners, medical practices, and hospitals. Examples of such programs are loans for the purchase of practices, lines of credit for working capital, and equipment leasing schemes.

Consumer lending is another rapidly expanding subset of specialty finance. Personal loans, vehicle loans, and credit cards are increasingly being offered by specialist lenders as a result of the financial crisis, which has caused regular banks to tighten their lending standards. When compared to more conventional banking options, these specialty lenders typically have more accommodating conditions and quicker approval times.

Investors in real estate have also discovered the usefulness of specialty finance organizations that focus on providing bridge loans or fix-and-flip financing for investment properties. A middle ground between hard money lenders and conventional bank mortgages, these loans are for shorter periods of time.

Adaptability to shifting market conditions and meeting specialized consumer demands that mainstream financial institutions overlook have contributed to the creation of the specialty finance business. These businesses save time and effort while still meeting customer needs by making underwriting decisions based on a variety of data sources, including technology.

Looking ahead, it’s certain that this trend will persist as more entrepreneurs discover niche market opportunities and pursue innovative funding solutions for their businesses. As it continues to adapt to new trends in industries such as healthcare, consumer lending, and real estate investment, the future of the specialty finance sector appears promising.

Varying Forms of Specialty Financial Institutions

The provision of industry-specific services and solutions by specialty finance companies is an essential component of the financial ecosystem. These businesses fill a need in the market that may be unmet by more conventional financial institutions. First, we will look at the most typical kinds of specialty finance firms:

- Equipment Financing: This specialty finance organization specializes in providing financing for the purchase of equipment to businesses in many industries, including construction, healthcare, and manufacturing. They provide adaptable financing plans or leasing choices for the purchase of vehicles, technology, and machinery.

- One solution that firms can find is invoice factoring. These companies buy outstanding invoices from businesses at a discounted rate and use the money to help with working capital. Businesses can avoid waiting for clients to pay their invoices and get access to funds immediately.

- Small businesses can receive cash advances from these specialty finance companies based on the amount of credit card sales they anticipate making in the future. For entrepreneurs who require funds urgently but don’t want to wait for traditional loan approval processes, this is a viable alternative.

- Real Estate Financing: Specialized real estate finance companies focus on providing funding for property development projects, commercial mortgages, bridge loans, and other real estate-related transactions.

- Healthcare Finance: With complex laws and payment arrangements in the healthcare industry, specialty finance organizations specializing in healthcare lending help medical practices and facilities manage cash flow difficulties successfully.

- Personal Loans: Consumers with less-than-perfect credit or other unusual borrowing circumstances may be able to get a loan from a specialty finance company that doesn’t work with banks.

This is by no means an exhaustive list; the specialty finance business as a whole encompasses many more subsectors that cater to niche industries, such as energy financing and franchise financing.

Individuals can better assess which specialty finance firms meet their investment objectives or think about using their services when looking for specialized sector financial assistance if they have a good grasp of the several kinds of specialty finance companies that are currently available.

The Pros and Cons of Specialty Financing

Investors and borrowers alike can benefit from the services offered by specialty finance companies. One key advantage is that specialty finance firms focus on narrow markets, allowing them to build specialized knowledge and skills in specific industries or asset classes. This specialization helps these organizations to better understand the demands of their clients and design their financial offerings accordingly.

Another advantage of specialty finance is its capacity to provide lending options for individuals or organizations with non-traditional credit profiles. These borrowers may have been rejected down by regular banks due to considerations such as insufficient operating history or weak credit scores. Specialty finance organizations are frequently more prepared to take on higher-risk borrowers, providing them with access to much-needed financing.

Additionally, specialty finance can offer unique lending forms and conditions that may not be offered through standard lenders. For instance, depending on the borrower’s unique situation, specialist lenders may provide extended payback terms or flexible interest rates. Borrowers are able to better manage their cash flow and satisfy their individual financial needs thanks to this flexibility.

Specialty finance presents its own unique set of difficulties, though. The possibility of paying more in interest than with more conventional loan methods is one obstacle. These businesses charge higher interest rates to cover the additional risk associated with serving riskier parts of the market.

Regulatory compliance standards might be confusing because they differ from one jurisdiction to another. Complex legal frameworks and constant adherence to relevant rules are constant challenges for specialty finance firms.

In conclusion, specialty finance continues to play a key role in filling voids created by conventional lenders, despite the fact that it has both advantages and disadvantages. The sector’s future seems bright, thanks to the constant flow of new prospects and technological developments.

Making Money in Specialty Finance

A diversified investment portfolio with the potential for higher returns can be yours with an investment in specialty finance. Those interested in investing in this specialized field should think about the following.

It’s crucial to be familiar with the many varieties of specialty finance firms. Some examples of these entities are leasing companies, asset-based lenders, factors, and specialty real estate financing corporations. The possible rewards and dangers of each kind are different.

Research comes next. Before putting your money into a company, make sure you do your research on its financial standing and performance. Investigate their past performance, loan portfolios, and the knowledge of their management.

Furthermore, it is essential to analyze the current state and future trajectory of the specialty finance market. Is specialist financing becoming more popular? Is there any chance that these businesses could be affected by new regulations? If you want to make smart financial selections, you should familiarize yourself with these factors.

When it comes to investing in specialty finance, diversification is key. To reduce the impact of any one company’s performance on your portfolio, consider investing in a variety of firms or funds operating in this industry.

Keep up with the latest news and trends in your field to keep your assets protected. To keep up with the latest developments and prospects in the specialty finance industry, subscribe to newsletters or publications that cover these subjects.

Keep in mind that you should talk to a professional financial advisor who can tailor their advice to your specific situation and objectives before making any investing decisions.

Where Do We See Specialty Finance Going From Here?

There is reason to be optimistic about the future of specialty finance, since the sector is well-positioned for further expansion and new developments. New chances for specialty finance organizations to broaden their customer base and increase their product offerings are created as technology continues to develop.

Alternative financing platforms are one sector predicted to have substantial expansion in the years ahead. People and companies who don’t fit the typical bank loan profile might nonetheless have access to finance through these platforms. There is a need in the industry for specialty finance organizations to meet the growing demand for these platforms as a source of capital.

There will also be a greater demand for specialty finance services that support cross-border investments and international transactions as the world economy becomes more integrated. For businesses that focus on trade financing and currency exchange, this is a fantastic opportunity.

Also, green infrastructure development, sustainable agriculture, and renewable energy are just a few areas where specialty finance companies are likely to be indispensable in meeting the growing demand for environmentally responsible and socially conscious projects.

As you requested, I will conclude by saying that specialty finance has a bright future. Innovation and growth potential abound in this area thanks to shifting market dynamics and technological developments. Adapting tactics and products is crucial for specialty finance organizations to stay relevant in this ever-changing landscape.

In summary

Within the financial sector, specialty finance has grown into a formidable and ever-changing force. Company specialization in specialty finance has allowed it to carve out a distinctive niche in the industry through its emphasis on niche lending and niche markets. Looking ahead, it’s easy to see that this business will keep growing and changing.

Several causes have contributed to the expansion of specialty finance. These include changes in legislative frameworks, technological improvements, and the rising need for customized financial solutions. All of these things have come together to make it easy for creative businesses to thrive and serve the unique requirements of borrowers in all kinds of industries.

Various industries and sorts of transactions are serviced by various kinds of specialty finance organizations. Businesses can find a variety of financing options, such as asset-based lenders who use assets like accounts receivable or inventory as security, equipment leasing firms that help with the upfront costs of equipment acquisition through leasing, and factoring companies that buy invoices from businesses at a discount.

The capacity to offer solutions that are uniquely suited to each borrower’s needs is a major strength of specialty finance. The intricacies and dangers of their clients’ enterprises can be better understood by these firms if they zero in on particular sectors or kinds of transactions. Because of this, they are able to provide more accommodating terms, quicker processing times, and easier accessibility than conventional banks.

But specialty finance has its share of problems, just like every other sector. Because of their niche focus, these companies are always adjusting their risk management and underwriting approaches to meet the demands of the market. In order to stay in compliance while offering novel financing choices, it can be tough to navigate complex rules.

Investors can gain exposure to the specialty finance sector through exchange-traded funds (ETFs) that target companies in this area, or they can invest directly in individual firms within the industry. Prior to making any investment selections, investors should perform comprehensive study and due diligence.

There are bright prospects for specialty finance in the future. Specialty finance is projected to continue as a result of continued technical improvements and an increasing need for customized financial solutions