Introduction stock market predictions.

My apologies! If you’re interested in exploring the fascinating world of stock market predictions, you’ve come to the right place! Your ability to comprehend and foretell the ebb and flow of the stock market will substantially impact your monetary prosperity, independent of your level of investment competence. Learn the ins and outs of the stock market and what drives its ups and downs in this in-depth essay. To better understand what’s to come, let’s review previous trends and expert viewpoints. In this illuminating adventure through the ever-shifting stock market, you can expect to learn about forecasts, tactics, and opportunities.

The Basics of Stock Market Investing

Despite first impressions, the stock market is actually rather easy to understand provided you have a firm handle on the fundamentals. The primary function of a stock market is the trading of shares in publicly listed corporations. Investors can purchase and sell equities on this platform, which is similar to a large marketplace.

Acquiring a tiny stake in a corporation is analogous to purchasing shares. If you know this, you’ll have a much easier time navigating the stock market. Your stock’s value may rise if the company achieves its goals and expands.

Primary and secondary markets are the two main types of marketplaces. Investors trade pre-existing equities on the secondary market, while new stocks are issued on the primary market through initial public offerings (IPOs).

Market forces of supply and demand cause daily price fluctuations in stocks. When demand is high and supply is low or when a company is the subject of negative news, stock prices go up.

Remember that there is always some degree of risk involved when investing in the stock market. A number of factors, including the state of the economy, current political situations, and even investor sentiment, can influence the degree to which prices are volatile and unpredictable. As a result, before putting their money down, investors should conduct their research.

Having a deep comprehension of how the stock market functions is crucial for thriving in the complex financial landscape of today. Anyone may become a good investor with time and instruction on various investment methods and risk management tactics, even though it could appear daunting at first. Since there is no such thing as a risk-free investment, you should only put your money where your mouth is. I wish you success with your investment.

Factors That Have an Impact on Stock Prices

There are a lot of moving parts in the stock market, which makes it complicated and unpredictable. Investors will be better equipped to navigate the volatile market and make educated choices with this information.

The stock market responds to changes in economic data in a timely manner. Among the numbers included in this compilation are employment rates, inflation rates, and GDP growth rates. Stock prices typically go up when investors become more optimistic as a result of encouraging economic data.

The interest rates that are determined by the central bank should also be considered. Low interest rates make borrowing money easier, which allows firms to invest and develop. As a result, stock prices tend to climb as investors expect the company to perform better.

Market mood also plays a significant role in determining how stock prices fluctuate. Investors’ faith in the future causes stock values to grow. Stock prices might fall and selling pressure can increase if investors are pessimistic about a specific industry or world event.

The stock market could be severely affected by a variety of external factors, such as natural disasters or geopolitical conflicts. Share prices fluctuate because these events increase market volatility and uncertainty.

When combined with the impact of earnings reports on both firms and the market as a whole, these elements constitute potent market movers. Shares of a company’s stock tend to rise following a positive earnings report, but fall following a negative one.

Investors need to be well-versed in all of these elements in order to keep up with the always changing stock market. Investors looking to ride the wave of a trend should keep an eye on key economic indicators, interest rate movements, market sentiment, and news from the outside world.

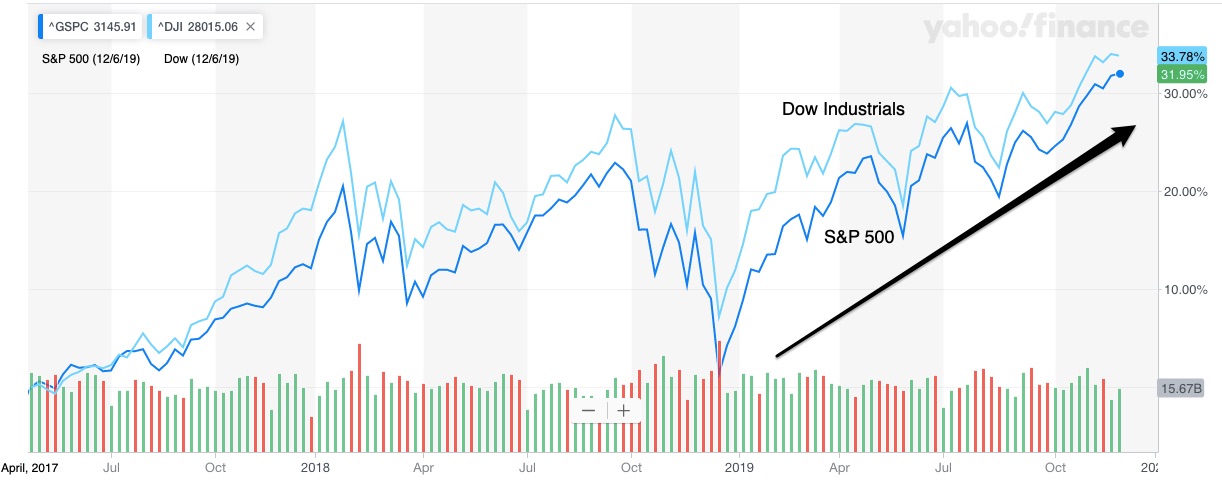

Analysis of Past Trends and Forecasting of Future Outcomes

There has been plenty of ups and downs in the stock market over the years. Several variables contribute to environmental volatility, including investor attitude, economic and political conditions, and other comparable issues. By studying previous patterns, we can have a better idea of what will be popular in the future.

A number of instances of fast expansion followed by precipitous declines have occurred recently. A lot of people were scared when the dot-com boom of 2000 crashed. After that, in 2008, a global economic recession and the failure of many big banks were precipitated by a financial crisis.

It should be remembered, though, that stock markets have historically bounced back from slumps like these, reaching even greater heights in the end. The speed with which it recovers from setbacks is an indicator of its resilience.

As long as online shopping, cloud computing, and AI keep getting better, many think tech stocks will be a solid investment. The public’s growing concern for the environment is likely to fuel expansion in the renewable energy industry.

Although it is hard to accurately forecast the stock market’s future performance, investors can still benefit from studying past trends when making portfolio decisions. The effect of downturns can be lessened by spreading an investor’s holdings across several businesses and asset types.

Finally, the fact that Although there is no constant in the stock market, investors can remain ahead of the curve by analyzing previous trends and taking expert predictions into account.

Advice and Prognosis from Industry Insiders

Investors put a lot of faith in the forecasts and opinions of market experts when trying to forecast the stock market. Predictions are made by these experts after reviewing a mountain of data, which includes economic indicators, company performance, and market patterns.

Technical analysis is a common method used by specialists. The way we do this is by looking at price and volume data from the past and making predictions about the future. Graphologists and chartists are experts in the field of stock price prediction by means of visual aids such as charts and graphs.

However, the goal of fundamental analysis is to get to the bottom of a company’s financial health and growth prospects. Forecasts using this strategy take into account industry projections, competitive advantages, earnings reports, and revenue sources.

When making investing decisions, it’s important to remember that expert opinions aren’t necessarily right. Many factors affect the stock market, and some of those factors might change quickly. No amount of confidence can be used to forecast how the market will behave in the future.

In times of uncertainty, investors can benefit greatly from the insights provided by specialists in the field who have extensive knowledge and expertise in that area. Before you put down any cash, you should weigh all of your options thoroughly.

Last but not least (my error!), while trying to forecast the stock market, expert opinions should be considered as just one factor among many. Though they provide useful insights into possible trends and opportunities, investors shouldn’t put all their eggs in these estimations’ basket. Investing in the volatile stock market requires careful consideration of your own risk tolerance as well as extensive research from a variety of sources.